Did you know? Of the 85% of drivers who have a roadside program, only 18% actually use it when they experience a roadside event. The reason? Many drivers are misinformed about roadside coverage, causing misconceptions that pose a barrier to usage and adoption. As a result, drivers aren’t utilizing services they’re already paying for to their advantage, and end up taking on unnecessary costs – be it time, money, or energy. We’re here to hit the brakes on roadside misinformation. See if you can correctly assess roadside myths vs. facts.

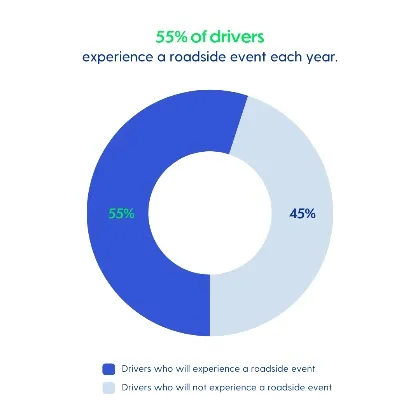

Your chances of needing roadside assistance are slim to none.

True

You'd be surprised!

You always think it'll never happen to you...until it does! Truth: Just over 1 in 2 drivers experience a roadside event every 12 months. Your chances of needing roadside are higher than you think. When that day comes, make sure you have coverage and know how to access it!

False

That's correct!

Did you know that every 1 in 2 drivers experiences a roadside event every 12 months? It's not a matter of "if" you'll need roadside, but "when". When that day comes, make sure you have coverage and know how to access it!

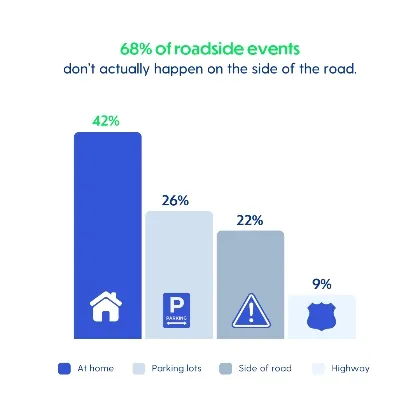

Roadside assistance can only be used if your vehicle is on the side of the road.

Yep, that's right

Don't be fooled!

Contrary to what its name implies, roadside assistance can be used anywhere your vehicle is disabled. In fact, most “roadside” events take place in parking lots (26%) and at home (42%). Some roadside plans even assist with home lockouts.

Nope, don't think so

Good call!

Roadside assistance isn’t just for the side of the road. It can help you no matter where your vehicle is disabled. In fact, most “roadside” events actually occur in parking lots (26%) and at home (42%). Some roadside plans even assist with home lockouts.

The best predictor of whether or not a vehicle will experience a roadside event is its age.

Of course

It's actually not!

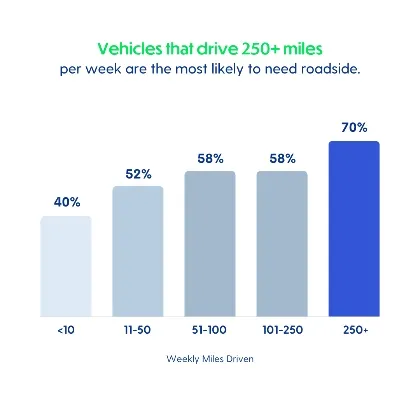

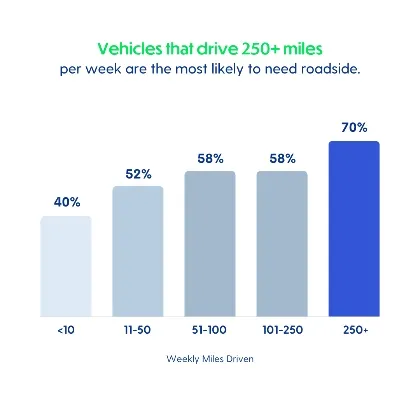

The older the vehicle is, the more likely it will experience some sort of disablement issue, right? Wrong! While this may seem logical, the best predictors of roadside are actually a vehicle’s mileage and drivetrain. The more a vehicle is driven, the more likely it will experience a roadside event. This is especially true for electric vehicles.

Highly unlikely

That's right!

The best predictors of roadside are a vehicle’s mileage and drivetrain – not age. An older car that is driven minimally is less likely to experience a roadside event than a newer car that is driven heavily. This is true especially for electric vehicles.

DIY-ing is faster and cheaper than requesting professional help via roadside assistance.

Agree

Common misconception!

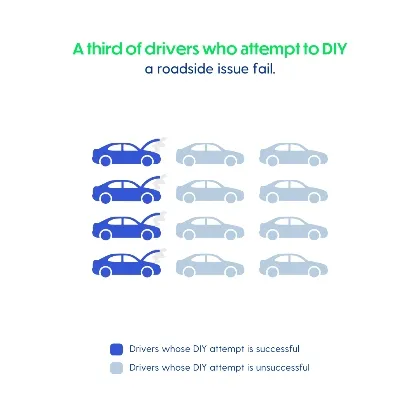

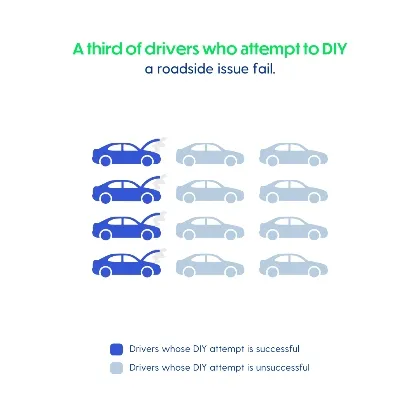

DIY is more dangerous and complicated than you think. It can actually take longer and be more costly if you don’t have the time, know-how, or proper tools to diagnose and repair the issue. This is why you should never DIY a roadside issue. Serious injuries can–and have–occurred as a result. Leave it to the pros!

Disagree

We're glad you get the picture!

About half of drivers who attempt to fix a roadside issue themselves fail, and additional help is needed. Using roadside assistance is actually the fastest, easiest, and–most importantly–safest way to get your vehicle back on the road effectively and efficiently.

Using roadside assistance will count as a claim and affect my insurance premium.

Absolutely

It depends.

Well, the truth is, it’s a little more complicated than black and white. While many auto insurance carriers do not count the usage of roadside as a claim, some do have limitations on the amount of times you can use coverage within a particular time frame; a practice put in place to prevent abuse of the program. Make sure you understand what your carrier’s regulations are regarding usage limitations (if any).

Probably not

Can vary by carrier.

Well, the truth is, it’s a little more complicated than black and white. While many auto insurance carriers do not count the usage of roadside as a claim, some do have limitations on the amount of times you can use coverage within a particular time frame; a practice put in place to prevent abuse of the program. Make sure you understand what your carrier’s regulations are regarding usage limitations (if any).